Back to Phases of Portfolio Management

Tax Planning

Tax Planning

Appropriate tax planning is essential for protecting your financial future. We will work on your behalf to ensure your specific tax situation is managed and reaps the best benefits for you. Not only will this help protect your future, but it will also help you advance it.

*Source: Fiducient, 2025

Whether optimizing your portfolio or filing your returns, it’s easy to become confused over the ever-changing tax laws. Our team coordinates with our highly-skilled CPAs to reach your financial goals and advance your specific tax situation.

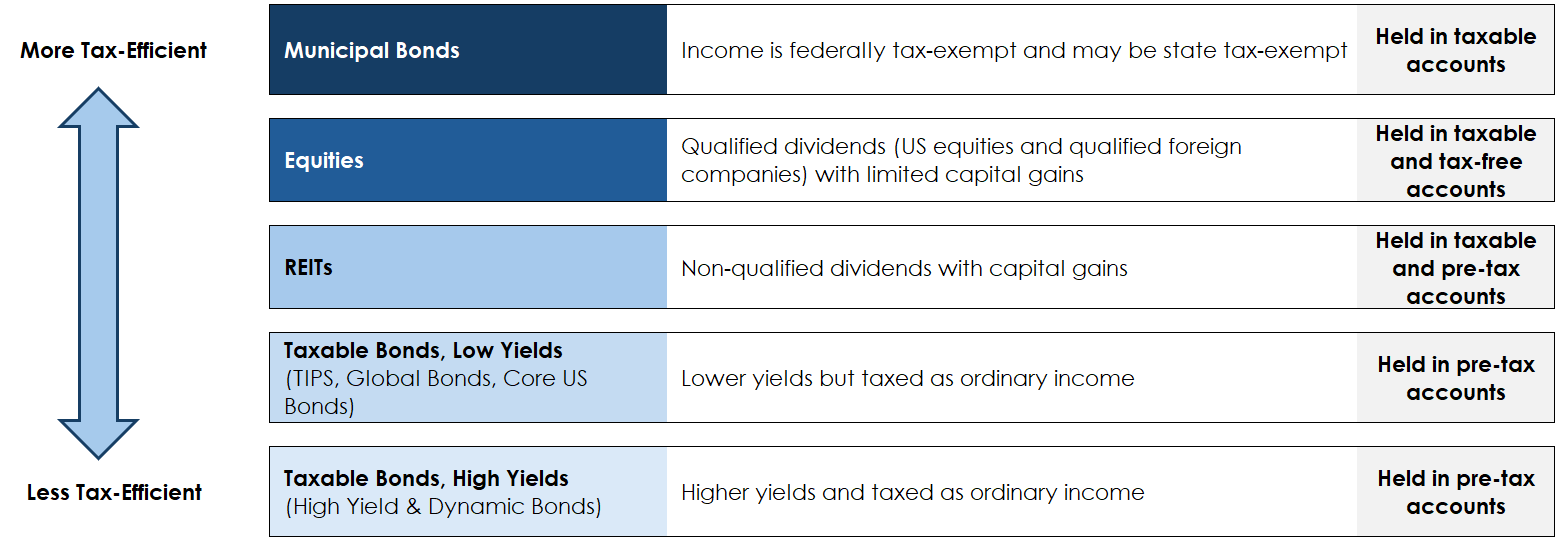

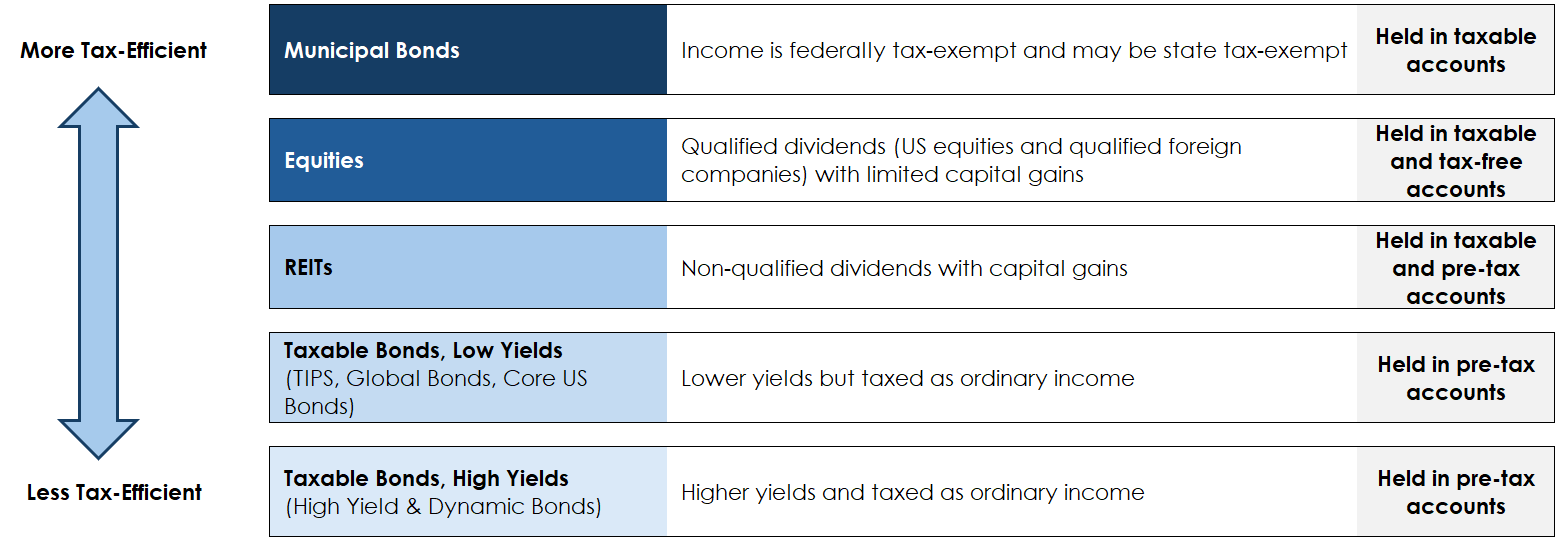

Optimizing Your Portfolio for Tax-Efficiency

Your portfolio itself can impact your tax situation. The taxation of portfolio income varies by asset class. An investor who has a combination of taxable and tax-deferred investment accounts can optimize a portfolio’s allocation to minimize tax drag, thereby enhancing long-term after-tax returns.

*Source: Fiducient, 2025

Whether optimizing your portfolio or filing your returns, it’s easy to become confused over the ever-changing tax laws. Our team coordinates with our highly-skilled CPAs to reach your financial goals and advance your specific tax situation.