Back to Phases of Portfolio Management

Risk Management

Risk Management

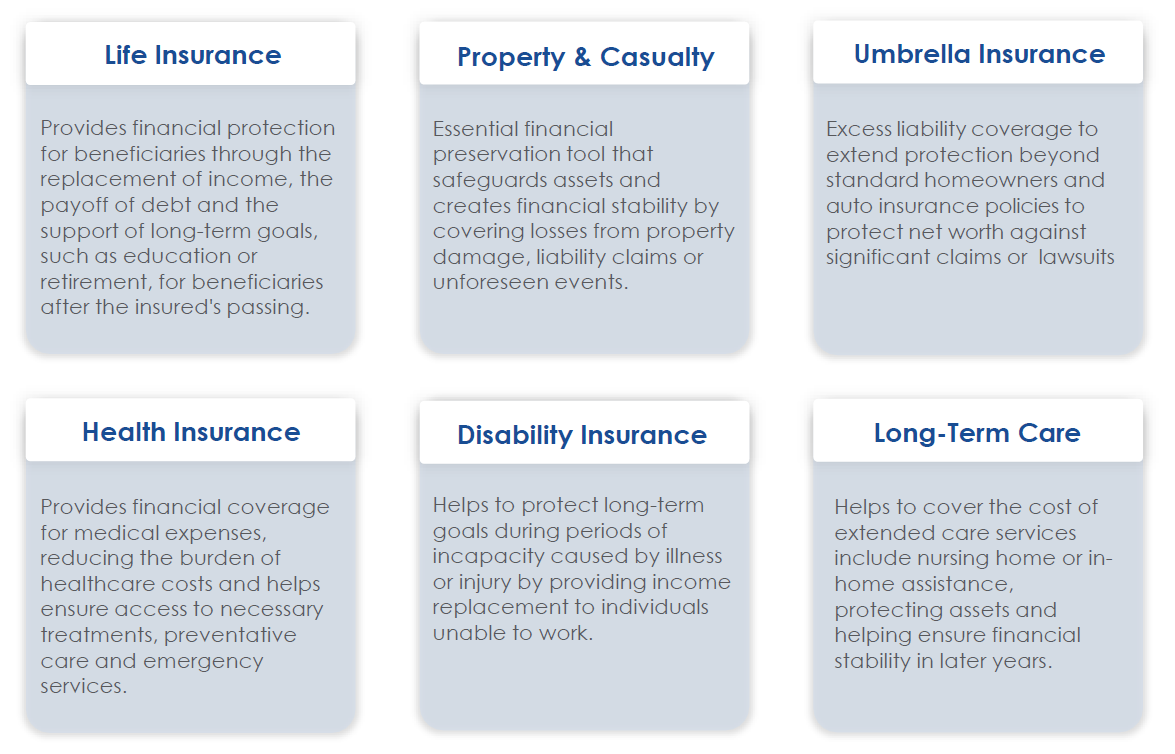

Risk management does not only involve risks you are willing to take in terms of investments. Life is full of risks, and despite our best-laid plans, sometimes the unthinkable happens.

By working with licensed insurance professionals, we look into and provide recommendations for areas such as:

*Source: Fiducient, 2025

By working with licensed insurance professionals, we look into and provide recommendations for areas such as:

- Life-insurance

- Disability

- Long-term care insurance

*Source: Fiducient, 2025