Back to Phases of Portfolio Management

Estate Planning

Estate Planning

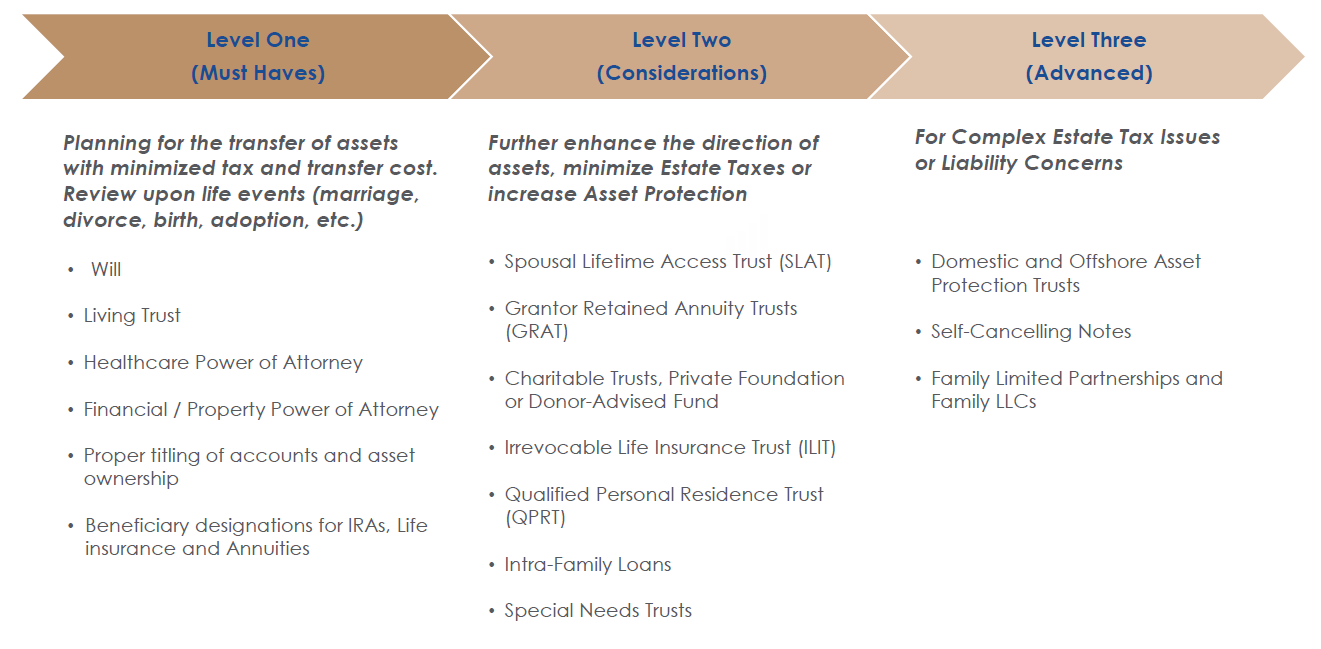

It is not uncommon for us to meet with a client who either has no estate plan, or whose estate plan is outdated and needs updating. We will work with your estate planning attorneys to ensure your estate is passed along according to your wishes, and – if applicable – reduce your taxes. We can also recommend an attorney if you do not currently have one.

There are many options available to our clients with goals extending beyond their own lifetime. For instance, we can employ gifting strategies to distribute assets to your family members or charities during your lifetime. Another option is to plan for a specific bequest - an amount of money that can be carved out of your total portfolio that will have a specific purpose at the time of your passing. Whatever you feel is best for you, we will support you on these goals.

*Source: Fiducient, 2025

Questions to consider include:

- Should you have a trust to protect your assets?

- Do you have beneficiaries listed, and are they up to date?

- What’s the most tax-efficient way to leave your assets to charities?

- Do you feel comfortable with who is going to administer your estate at my passing or in the event your incapacitated?

- Have you identified your healthcare attorney?

There are many options available to our clients with goals extending beyond their own lifetime. For instance, we can employ gifting strategies to distribute assets to your family members or charities during your lifetime. Another option is to plan for a specific bequest - an amount of money that can be carved out of your total portfolio that will have a specific purpose at the time of your passing. Whatever you feel is best for you, we will support you on these goals.

*Source: Fiducient, 2025