Back to Phases of Portfolio Management

Charitable Giving Planning

Charitable Giving Planning

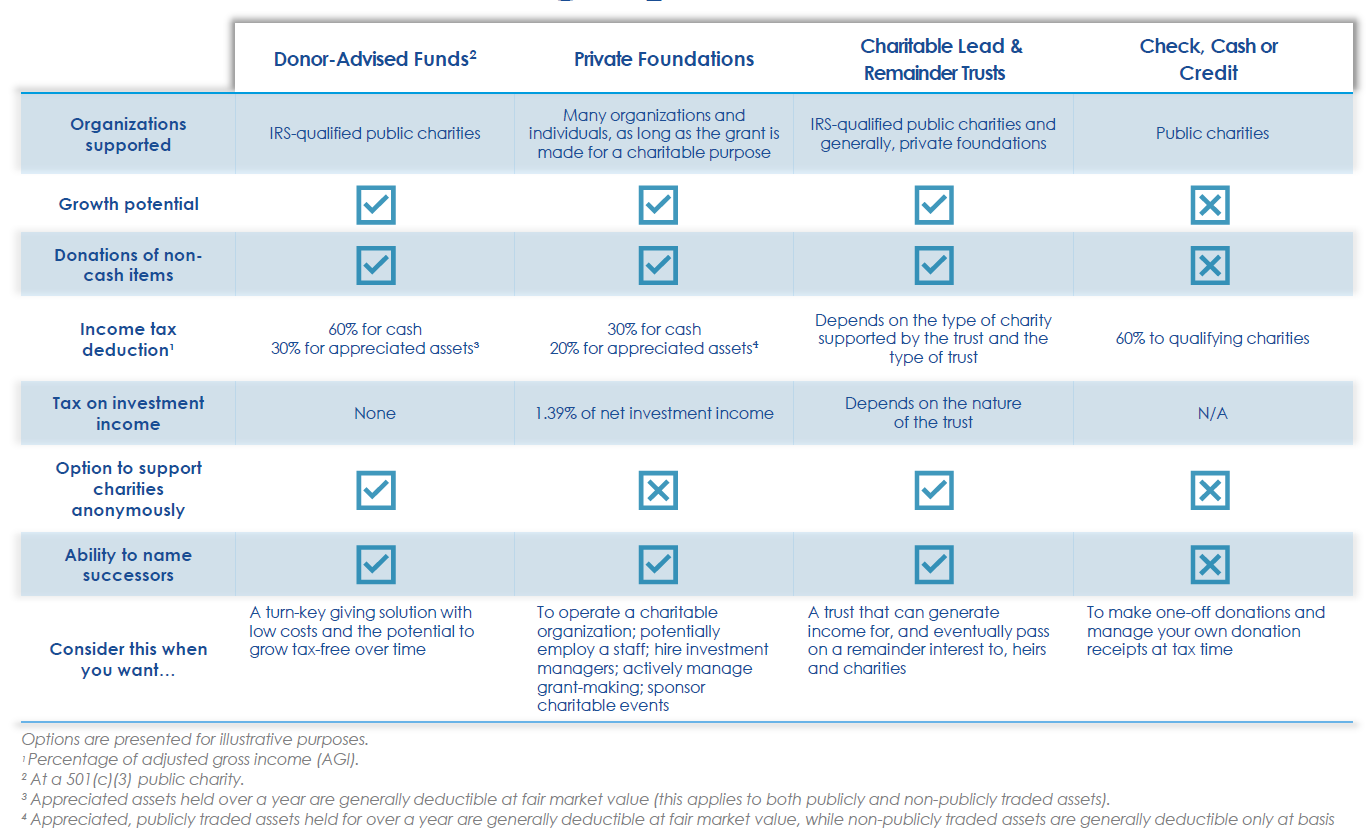

Using cash or credit cards often seems like the path of least resistance for making donations; however, it is worth considering alternatives.

By using long-term appreciated securities from a taxable account or possibly making a Qualified Charitable Distribution (QCD) from an IRA, you may be able to provide a larger contribution to charity while also possibly enhancing the tax benefit for you and your family. If you have higher-than-normal income in a given year, you might consider bunching multiple years’ worth of charitable gifts into a single tax year to produce a higher itemized deduction total. Pairing this planning strategy with a donor-advised fund or a private foundation can be particularly effective.

*Source: Fiducient, 2025

*Source: Fiducient, 2025

Taking the time and energy to find the approach which best fits your situation can maximize the effectiveness and efficiency of charitable gifts. We guide you through the options to ensure you can make the optimal choice for your situation.

To learn more, please reach out to speak to one of our advisors!

By using long-term appreciated securities from a taxable account or possibly making a Qualified Charitable Distribution (QCD) from an IRA, you may be able to provide a larger contribution to charity while also possibly enhancing the tax benefit for you and your family. If you have higher-than-normal income in a given year, you might consider bunching multiple years’ worth of charitable gifts into a single tax year to produce a higher itemized deduction total. Pairing this planning strategy with a donor-advised fund or a private foundation can be particularly effective.

Taking the time and energy to find the approach which best fits your situation can maximize the effectiveness and efficiency of charitable gifts. We guide you through the options to ensure you can make the optimal choice for your situation.

To learn more, please reach out to speak to one of our advisors!