Back to News & Insights

When Uncertainty is High, Context is Grounding

When Uncertainty is High, Context is Grounding

When Uncertainty is High, Context is Grounding

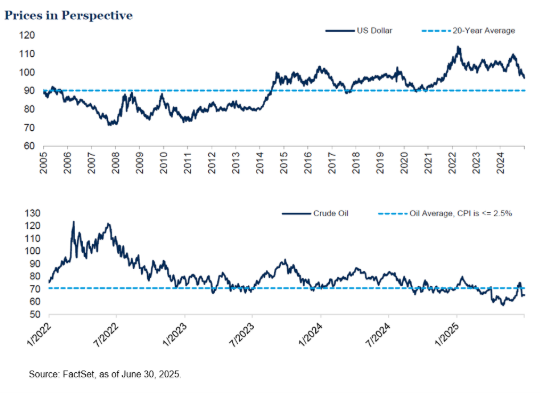

In a market environment that often reacts faster than it reflects, uncertainty is an almost constant companion. Today, that uncertainty is elevated, and understandably so. Fiscal dynamics are rapidly shifting; inflation is caught between opposing forces and policy is in flux. It is a time that calls for clarity, not certainty. And when clarity is hard to come by, context becomes our foundation.Much has been made of recent U.S. dollar weakness and grumblings regarding the U.S. potentially losing its reserve currency status (a topic for another day). Similarly, with rising tensions in the Middle East, the price of oil has moved upward over the month, adding to inflation concerns. At first glance investors may have concern, but with a bit of context that concern may abate.

If we were to rephrase “U.S. dollar weakens -11% year-to-date” to “U.S. dollar retraces back to 2022 levels, remaining over 7% above the 20-year average” it may elicit different levels of concern. Or, if we mention that oil is below average historical levels where inflation was around 2.5%, that may also prompt varying degrees of concern. Context matters.

Big Bill, Big Deficit

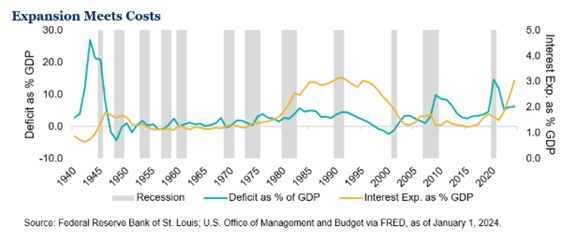

Treasury markets have long absorbed large issuance volumes, though with the recent lack of clarity buyers are asking for more compensation (i.e., higher rates). The context on why brings us to the so-called “Big Beautiful Bill.” As proposed, the U.S. will be expanding its deficit in a non-recessionary environment. Typically, the government tends to spend more in recessionary periods to offset lower consumer spending and cushion the blow. The opposite should hold true in periods where markets are growing. With interest expense over 3% of GDP and no recession in sight, this combination is historically rare. With debt levels elevated and rolling into higher rates, the long-term sustainability of U.S. borrowing is beginning to re-enter investor conversations.

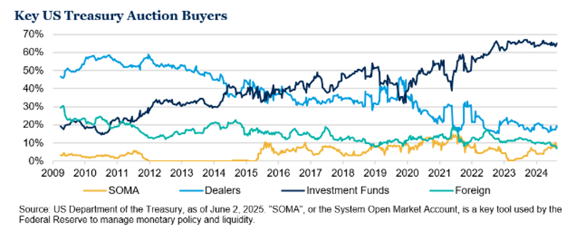

Additionally, investment funds now dominate at Treasury auctions, rather than previously obligated buyers like central banks or dealers. This has the potential to make Treasury markets more sensitive to sentiment and flows which can impact the cost of funding a large deficit. For investors without explicit clarity on the future direction of rates (which means all of us), the long end of the Treasury market may present as more volatile in this period of uncertainty.

Outlook

The dollar is weakening. The deficit is growing. The curve is steepening. Rates remain elevated. These signals are not pointing in one direction, but they are flashing that the market is uncertain and deeply sensitive to fiscal and monetary decisions.When uncertainty is high, context is grounding. And context today tells us that even with policy rates likely to fall at some point, the path there may not be smooth, especially if the market starts asking harder questions.

Update for July 25, 2025

Source, Fiducient 2025

Views expressed are as of the date(s) referenced, based on the information available at that time, and may change based on market and other conditions. These are the views of the authors’ of this piece and may differ from other advisors within RubinBrown Advisors, LLC. RubinBrown Advisors does not assume any duty to update any of the information. Sources used and referenced in preparing this commentary are deemed to be reliable, but RubinBrown Advisors has not verified their accuracy. Information provided in this email is for informational and educational purposes only, it should not be construed as a specific recommendation of any security, sector or investment strategy. Please contact your investment advisor to discuss your personal portfolio. Investment decisions should be based on an individual or family’s own goals, time horizon and tolerance for risk.

RubinBrown Advisors, LLC is an SEC-registered investment advisor under the Investment Advisers Act of 1940. RubinBrown Advisors, LLC is wholly-owned by RubinBrown LLC.