Back to News & Insights

Data Uncertainty

Data Uncertainty

“As an investor, humility is key. The market doesn’t owe us clarity. The job is not to know the future with certainty, but to navigate the uncertainty with discipline.” - Lance Roberts

In the meantime, the Federal Reserve and investors will need to rely on privately sourced market data to assess the direction of the economy. At the beginning of each month, the Institute for Supply Management (ISM) releases a report after surveying businesses across the economy. The ISM® PMI® Reports continue to be consistent and accurate in indicating the direction of the overall economy, in addition to the manufacturing and services sectors.

The data for September showed weaker activity in both manufacturing and services sectors. The composite fell below 50, indicating stagnating economic growth. The inflation data leveled off but at a high level suggesting that inflation could move higher in the near term.

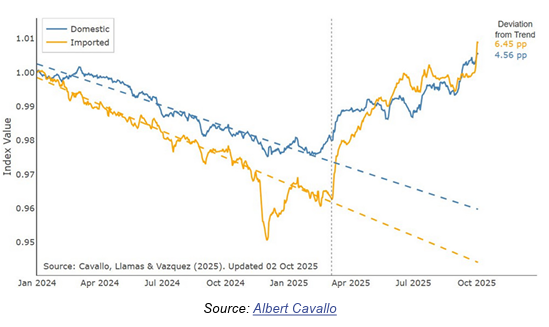

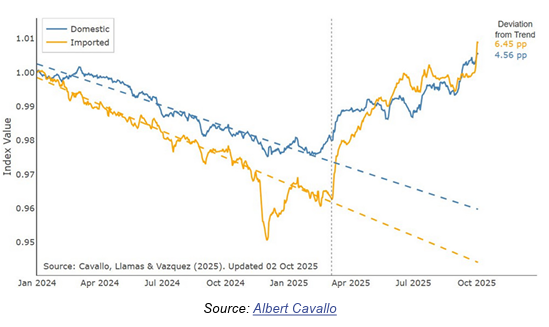

Mauldin economics recently published a chart showing the impact of tariffs on inflation. “This year we’re all wondering if/when/where the new tariffs will affect consumer prices. The impact varies considerably, so any reliable answer requires a lot of data. The Pricing Lab has the most comprehensive dataset we’ve seen. They collect daily price data from five major US retailers, then cross-reference it against country of origin data to classify each item as domestic or imported. This chart is the result.”

“Indexes of both domestic and imported goods prices fell in 2024, with imports falling even more. Both indexes turned higher in Q1 2025, with the previously lower import prices quickly catching up to and surpassing domestic goods. Measured from where the 2024 trends would have placed them, imported consumer goods prices are now almost two percentage points above domestic ones. This shows the tariffs working exactly as intended – giving domestic goods a price advantage. But this is a broad average; American-made goods don’t exist for every category. And the price increases are still substantial even for made-in-the-USA products, perhaps because hobbling foreign competitors lets American producers raise their prices. Bottom line: After falling for years, goods prices are mostly rising whether you “buy American” or not. Unless service prices (like housing) fall enough to offset this increase, expect higher inflation.”

Based on the data that we do have, it is fair to say that the outlook for employment and inflation does not appear to have changed much since our September meeting four weeks ago… While official employment data for September are delayed, available evidence suggests that both layoffs and hiring remain low, and that both households' perceptions of job availability and firms' perceptions of hiring difficulty continue their downward trajectories.

Meanwhile, 12-month core PCE inflation was 2.9 percent in August, up slightly from earlier this year, as rising core goods inflation has outpaced continued disinflation in housing services. Available data and surveys continue to show that goods price increases primarily reflect tariffs rather than broader inflationary pressures. Consistent with these effects, near-term inflation expectations have generally increased this year, while most longer-term expectation measures remain aligned with our 2 percent goal.”

Update for October 17, 2025

Disclosures & Definitions

Views expressed are as of the date(s) referenced, based on the information available at that time, and may change based on market and other conditions. These are the views of the authors’ of this piece and may differ from other advisors within RubinBrown Advisors, LLC. RubinBrown Advisors does not assume any duty to update any of the information. Sources used and referenced in preparing this commentary are deemed to be reliable, but RubinBrown Advisors has not verified their accuracy. Information provided in this email is for informational and educational purposes only, it should not be construed as a specific recommendation of any security, sector or investment strategy. Please contact your investment advisor to discuss your personal portfolio. Investment decisions should be based on an individual or family’s own goals, time horizon and tolerance for risk. RubinBrown Advisors, LLC is an SEC-registered investment advisor under the Investment Advisers Act of 1940. RubinBrown Advisors, LLC is wholly-owned by RubinBrown LLC. Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses. Market returns shown in text are as of the publish date and source from Morningstar or FactSet unless otherwise listed.

• The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

• Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

• MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

• MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

• Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

• Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

• FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

• Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

Material Risks

• Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

• Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

• Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

• International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impacted by currency and/or country specific risks which may result in lower liquidity in some markets.

• Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

• Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrower.

All investing involves risk including the potential loss of principal. Market volatility may significantly impact the value of your investments. Recent tariff announcements may add to this volatility, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. You should consider these factors when making investment decisions. We recommend consulting with a qualified financial adviser to understand how these risks may affect your portfolio and to develop a strategy that aligns with your financial goals and risk tolerance

Data Uncertainty

The economy has been flashing conflicting signals as inflation has recently ticked higher and above the Federal Reserve’s 2.0% target, the labor market has weakened and yet the stock market continues to hit record highs. The federal government shutdown has added uncertainty, potentially delaying paychecks for millions and disrupting the release of key economic data on employment and inflation.In the meantime, the Federal Reserve and investors will need to rely on privately sourced market data to assess the direction of the economy. At the beginning of each month, the Institute for Supply Management (ISM) releases a report after surveying businesses across the economy. The ISM® PMI® Reports continue to be consistent and accurate in indicating the direction of the overall economy, in addition to the manufacturing and services sectors.

The data for September showed weaker activity in both manufacturing and services sectors. The composite fell below 50, indicating stagnating economic growth. The inflation data leveled off but at a high level suggesting that inflation could move higher in the near term.

Mauldin economics recently published a chart showing the impact of tariffs on inflation. “This year we’re all wondering if/when/where the new tariffs will affect consumer prices. The impact varies considerably, so any reliable answer requires a lot of data. The Pricing Lab has the most comprehensive dataset we’ve seen. They collect daily price data from five major US retailers, then cross-reference it against country of origin data to classify each item as domestic or imported. This chart is the result.”

“Indexes of both domestic and imported goods prices fell in 2024, with imports falling even more. Both indexes turned higher in Q1 2025, with the previously lower import prices quickly catching up to and surpassing domestic goods. Measured from where the 2024 trends would have placed them, imported consumer goods prices are now almost two percentage points above domestic ones. This shows the tariffs working exactly as intended – giving domestic goods a price advantage. But this is a broad average; American-made goods don’t exist for every category. And the price increases are still substantial even for made-in-the-USA products, perhaps because hobbling foreign competitors lets American producers raise their prices. Bottom line: After falling for years, goods prices are mostly rising whether you “buy American” or not. Unless service prices (like housing) fall enough to offset this increase, expect higher inflation.”

How will the Fed respond?

Fed Chairman Jerome Powell spoke to the National Association for Business Economics on Tuesday signaling another cut when the FOMC meets at the end of October. “Although some important government data have been delayed due to the shutdown, we routinely review a wide variety of public- and private-sector data that have remained available. We also maintain a nationwide network of contacts through the Reserve Banks who provide valuable insights.Based on the data that we do have, it is fair to say that the outlook for employment and inflation does not appear to have changed much since our September meeting four weeks ago… While official employment data for September are delayed, available evidence suggests that both layoffs and hiring remain low, and that both households' perceptions of job availability and firms' perceptions of hiring difficulty continue their downward trajectories.

Meanwhile, 12-month core PCE inflation was 2.9 percent in August, up slightly from earlier this year, as rising core goods inflation has outpaced continued disinflation in housing services. Available data and surveys continue to show that goods price increases primarily reflect tariffs rather than broader inflationary pressures. Consistent with these effects, near-term inflation expectations have generally increased this year, while most longer-term expectation measures remain aligned with our 2 percent goal.”

Update for October 17, 2025

Disclosures & Definitions

Views expressed are as of the date(s) referenced, based on the information available at that time, and may change based on market and other conditions. These are the views of the authors’ of this piece and may differ from other advisors within RubinBrown Advisors, LLC. RubinBrown Advisors does not assume any duty to update any of the information. Sources used and referenced in preparing this commentary are deemed to be reliable, but RubinBrown Advisors has not verified their accuracy. Information provided in this email is for informational and educational purposes only, it should not be construed as a specific recommendation of any security, sector or investment strategy. Please contact your investment advisor to discuss your personal portfolio. Investment decisions should be based on an individual or family’s own goals, time horizon and tolerance for risk. RubinBrown Advisors, LLC is an SEC-registered investment advisor under the Investment Advisers Act of 1940. RubinBrown Advisors, LLC is wholly-owned by RubinBrown LLC. Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses. Market returns shown in text are as of the publish date and source from Morningstar or FactSet unless otherwise listed.

• The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

• Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

• MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

• MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

• Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

• Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

• FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

• Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

Material Risks

• Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

• Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

• Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

• International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impacted by currency and/or country specific risks which may result in lower liquidity in some markets.

• Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

• Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrower.

All investing involves risk including the potential loss of principal. Market volatility may significantly impact the value of your investments. Recent tariff announcements may add to this volatility, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. You should consider these factors when making investment decisions. We recommend consulting with a qualified financial adviser to understand how these risks may affect your portfolio and to develop a strategy that aligns with your financial goals and risk tolerance