Added Confusion - Interest Rates, Inflation and Employment

Added Confusion - Interest Rates, Inflation and Employment

Added Confusion - Interest Rates, Inflation and Employment

Two important events happened last week – the Federal Open Market Committee met to discuss monetary policy, and the July Employment Report was released.

As expected, the Fed made no change in policy at their meeting keeping the target range for the federal funds rate at 4.25%-4.5% where it has been since December 2024. However, for the first time in a while, two Fed Governors dissented opting to reduce rates in July.

In his post-meeting press conference, Chair Powell discussed his view that economic activity has moderated but the labor market remains solid. He also discussed an inflation rate that has moved lower but higher than their 2 percent longer-run goal.

He further stated, “Changes to government policies continue to evolve, and their effects on the economy remain uncertain. Higher tariffs have begun to show through more clearly to prices of some goods, but their overall effects on economic activity and inflation remain to be seen. A reasonable base case is that the effects on inflation could be short-lived—reflecting a one-time shift in the price level. But it is also possible that the inflationary effects could instead be more persistent, and that is a risk to be assessed and managed.

Our obligation is to keep longer-term inflation expectations well anchored and to prevent a one-time increase in the price level from becoming an ongoing inflation problem. For the time being, we are well positioned to learn more about the likely course of the economy and the evolving balance of risks before adjusting our policy stance. We see our current policy stance as appropriate to guard against inflation risks. We are also attentive to risks on the employment side of our mandate. In coming months, we will receive a good amount of data that will help inform our assessment of the balance of risks and the appropriate setting of the federal funds rate.”

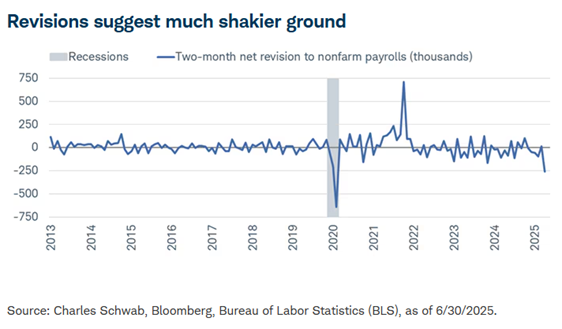

Two days later, the Bureau of Labor Statistics released the July Employment Report. Payrolls increased by 73,000 in July, which was weaker than the consensus estimate of 104,000. But more importantly, the prior two months were revised sharply lower. May's job gains were revised down from 144,000 to 19,000; June's gains were revised down from 147,000 to 14,000.

.png)

This reflects a longer-term trend of low initial response rates from businesses to the Labor Department’s monthly employer survey. This trend has accelerated post-Covid. Today, the initial average response rate is 68.3% (only 58% of business responded in July). In part this is due to the short time in which they must respond. By the second report, 89% of businesses responded and nearly 93% by the third revision. Higher response rates later give a more accurate account but can lead to large revisions.

In addition, data gathering has become more difficult exacerbated by layoffs and scarcer resources in the federal government. The labor department also makes an adjustment for small businesses, i.e. the birth-death adjustment. New businesses are established, and others go out of business. These are harder to survey and get an accurate initial account.

Beyond the accuracy and the data process of the monthly employment report, other employment surveys also suggest a slowdown in hiring. The widespread uncertainty in the current environment has led to low layoffs (as unemployment insurance claims have stayed low) but also a reluctance to hire.

The Job Openings and Labor Turnover Survey (JOLTS) is another key monthly report from the BLS. JOLTS focuses on labor demand by tracking job openings, hires, and separations. This report shows the slowdown in hiring.

ADP (Automatic Data Processing, Inc) is a company that provides human resource management software and services. Their National Employment Report is an independent and high-frequency view of the private sector labor market based on the aggregated and anonymized payroll data of more than 25 million US employees. This report tracks the BLS national private jobs report and collaborates the recent weakness.

.png)

Source: RubinBrown Advisors, ADP, BLS as of July 2025

A couple of other notable statistics from the BLS Employment report were the 3-month diffusion index (see below) and the number of long-term unemployed. The diffusion index measures the dispersion of employment gains across industries with 50 as the midpoint indicating an even distribution of job gains and losses across all industries. With revisions the 3-month diffusion index fell below 50 for the third month. Historically, this has indicated a recessionary environment.

.png)

Source: RubinBrown Advisors, BLS as of July 2025

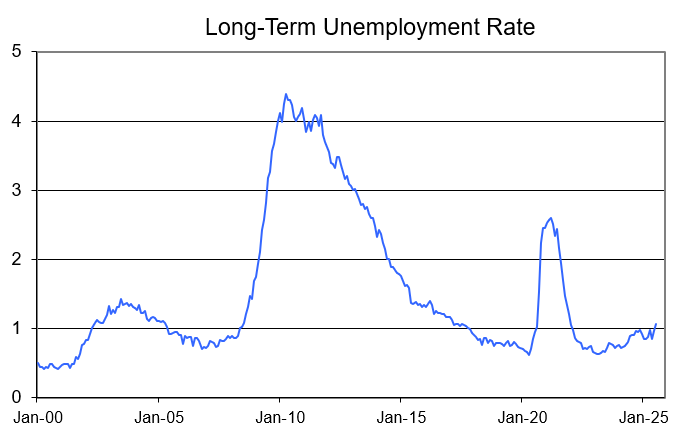

Reflecting the difficulty in finding a job, the number of long-term unemployed (over 27 weeks) has increased.

.png)

Source: RubinBrown Advisors, BLS as of July 2025

Following the Friday report, the September odds of a Fed interest rate cut increased from 40% to 80%.

The Fed and Mortgages

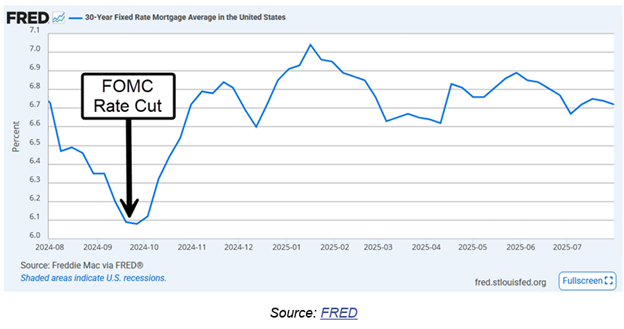

If the Fed reduces the federal funds rate, which is a short-term interest rate, it does not necessarily mean that the long-term interest rate moves lower. The 10-year Treasury rate is what determines mortgage rates. A fed rate cut will not necessarily make housing more affordable. When the Fed cut the federal funds rate in September 2024 the 30-year mortgage rate increased and stayed higher (see below chart).

This is because the Fed has no direct control over long-term rates. They are set by the bond market which, at least last year, was obviously more concerned about inflation. Expectations for another rate cut rose last week following weak economic data, but mortgage rates barely moved. Bond investors still seem to see inflation as their main worry.

Update for August 8, 2025

Views expressed are as of the date(s) referenced, based on the information available at that time, and may change based on market and other conditions. These are the views of the authors’ of this piece and may differ from other advisors within RubinBrown Advisors, LLC. RubinBrown Advisors does not assume any duty to update any of the information. Sources used and referenced in preparing this commentary are deemed to be reliable, but RubinBrown Advisors has not verified their accuracy. Information provided in this email is for informational and educational purposes only, it should not be construed as a specific recommendation of any security, sector or investment strategy. Please contact your investment advisor to discuss your personal portfolio. Investment decisions should be based on an individual or family’s own goals, time horizon and tolerance for risk.

RubinBrown Advisors, LLC is an SEC-registered investment advisor under the Investment Advisers Act of 1940. RubinBrown Advisors, LLC is wholly-owned by RubinBrown LLC.