Back to News & Insights

The Federal Reserve Mandate

The Federal Reserve Mandate

The Fed’s Mandate

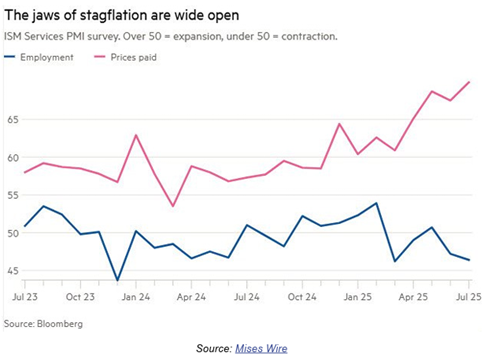

The Federal Reserve has a dual mandate: stable prices and maximum employment. The difficulty comes when these both move in the wrong direction, higher prices and softer employment. The chart below from the ISI Services PMI Survey shows the recent increase in prices (pink line) and weakening employment (blue).

The August 8 Update focused on the employment side of the mandate. This Update will look more at inflation.

Fed Minutes released Wednesday revealed the majority at the Fed “judged the upside risk to inflation as the greater of the two risks.” Fed Chairman Powell is speaking Friday at the Jackson Hole Symposium. Investors are awaiting any clarification on when the Fed may reduce short-term interest rates.

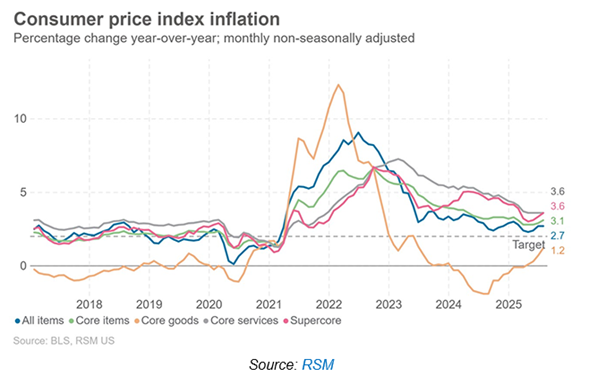

The recent Consumer Price Index (CPI) release was disappointing as the headline CPI increased 2.7% year/year, and the Core CPI (ex food and energy) increased 3.1%. The Fed has a 2.0% target. A deeper look at the data show service pricing (which is heavily influenced by labor costs) increased 3.6% year/year. Core goods prices, until recently, have been declining, helping offset the more stubborn services prices. But, beginning in April, core goods prices turned positive (yellow line). Tariffs are likely behind this increase.

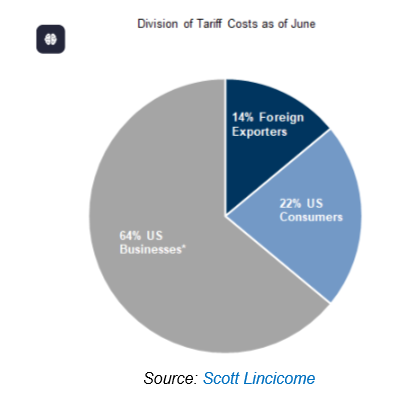

A Goldman Sachs analysis found that as of June, US consumers were only bearing 22% of the price impact. (See below). Businesses have absorbed most of the cost of tariffs so far, but if they decide to pass on to consumers, core goods prices could rise further. But keep in mind that if they don’t pass on, profit margins will shrink, which could lead to lower employment. So, you see the quandary for the Fed.

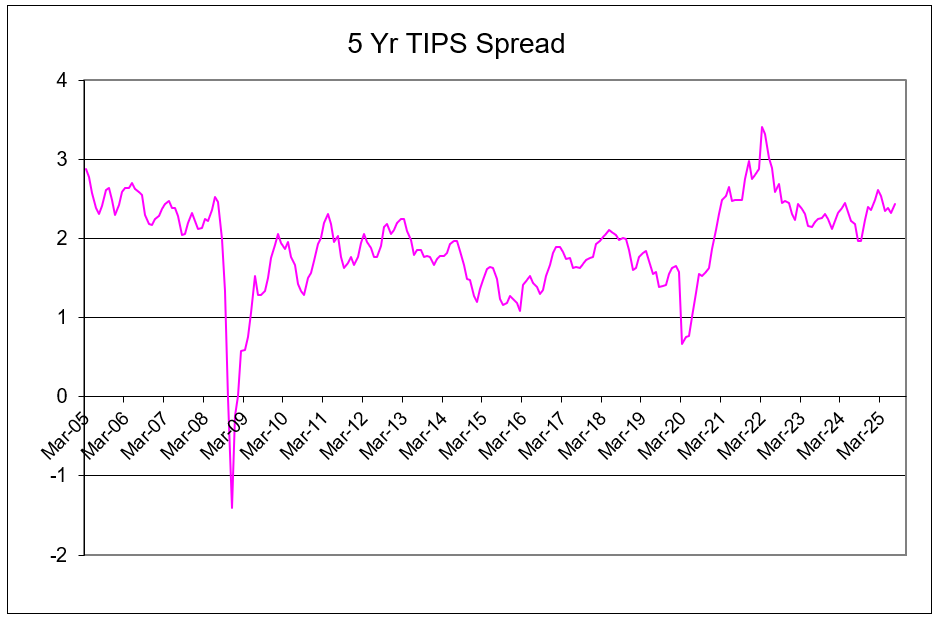

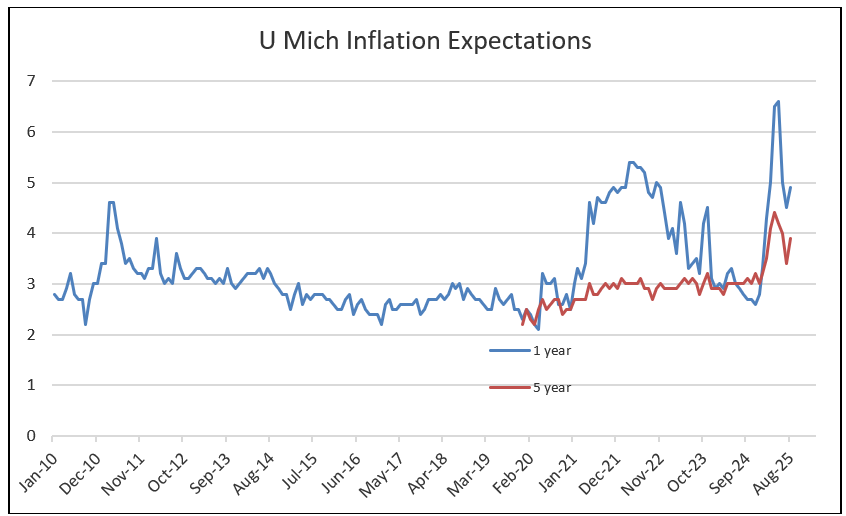

Market and consumer inflation expectations have recently moved up again. The five-year TIPS spread is the difference between 5-year Treasury rates and the 5-year TIPS rate which indicates expected inflation in the market. The University of Michigan surveys consumers twice a month and measures 1-year and 5-year inflation expectations.

Source: RubinBrown Advisors, Federal Reserve, as of July 2025

Source: RubinBrown Advisors, University of Michigan, as of mid-August 2025

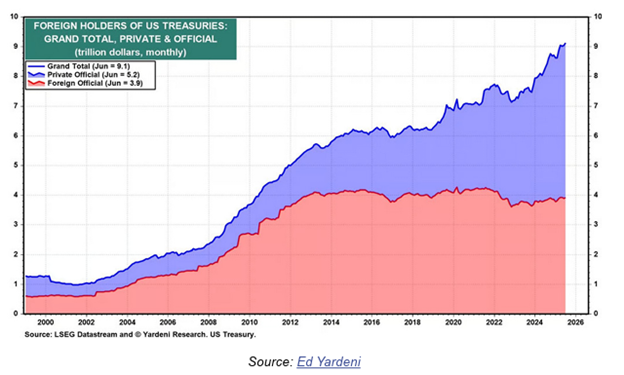

Foreign Treasury Holdings

“US dollar weakness this year sparked a lot of conversation about foreigners sending their capital elsewhere. This chart says it isn’t happening, at least not yet. Foreign investment in US Treasury debt actually expanded this year when you include both private and official holdings. However, we also know US debt issuance has been restricted since January due to the debt ceiling. The OBBBA legislation removed that obstacle, so debt is now growing again. If foreigners buy less, this chart could look quite different a year from now.” -Mauldin Economics

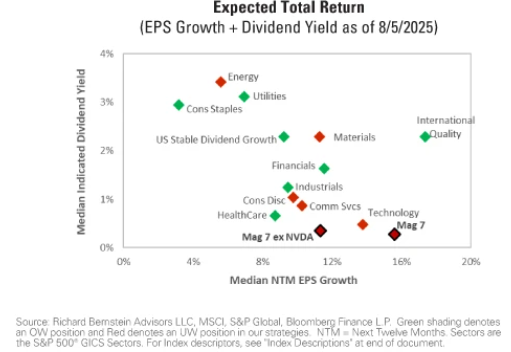

International Investing

This chart from Richard Bernstein Advisors shows one compelling reason to consider investing in non-US high quality companies. They have similar earnings growth (horizontal axis) as the US Magnificent 7 stocks (17% vs. 16%) and a much higher dividend yield (2.3% vs. 0.3%). In addition, they are valued at nearly a 35% discount.

Update for August 22, 2025

Views expressed are as of the date(s) referenced, based on the information available at that time, and may change based on market and other conditions. These are the views of the authors’ of this piece and may differ from other advisors within RubinBrown Advisors, LLC. RubinBrown Advisors does not assume any duty to update any of the information. Sources used and referenced in preparing this commentary are deemed to be reliable, but RubinBrown Advisors has not verified their accuracy. Information provided in this email is for informational and educational purposes only, it should not be construed as a specific recommendation of any security, sector or investment strategy. Please contact your investment advisor to discuss your personal portfolio. Investment decisions should be based on an individual or family’s own goals, time horizon and tolerance for risk.

RubinBrown Advisors, LLC is an SEC-registered investment advisor under the Investment Advisers Act of 1940. RubinBrown Advisors, LLC is wholly-owned by RubinBrown LLC.