Back to News & Insights

Third Quarter Investment Commentary

Third Quarter Investment Commentary

“Change of a long term or secular nature is usually gradual enough that it is obscured by the noise caused by short-term volatility. By the time secular trends are even acknowledged by the majority they are generally obvious and mature. In the early stages of a new secular paradigm, therefore, most are conditioned to hear only the short-term noise they have been conditioned to respond to by the prior existing secular condition. Moreover, in a shift of secular or long-term significance the markets will be adapting to a new set of rules while most market participants will be still playing by the old rules."

— Bob Farrell, “A Secular Inflection Point?,” Theme & Profile Investing, August 3rd, 2001

The Quarter in Review

- The One Big, Beautiful Bill Act (OBBBA) was signed into law on July 4, making many of the individual tax cuts and reforms of the TCJA permanent. It also included full expensing of capital investments.

- Equities experienced a notable rally during the quarter, particularly led by the technology and artificial intelligence (AI) sectors. Some analysts expressed concern that this performance, combined with ongoing risks, signaled a market bubble.

- U.S. Treasury bond yields experienced significant movement, largely driven by changing inflation data, a rate cut by the Federal Reserve, and a government shutdown at the quarter's end. The 10-year yield ended the quarter around 4.16% after reaching a high in July.

- The U.S. dollar weakened during the quarter, creating an unusual dynamic with rising bond yields. This was likely driven by increased fiscal concerns and improved economic prospects in other major economies.

- Gold surged during the quarter, hitting significant year-to-date gains as investors sought a hedge against uncertainty and inflation. Oil prices also saw a spike due to geopolitical events.

- The US Central Bank’s independence was questioned as President Trump pressured Federal Reserve Chairman Powell to reduce interest rates and tried to appoint more Fed Governors who favor rate cuts.

- Tariffs continue to put pressure on supply chains and contribute to increased costs for many companies. Some being passed on to consumers, pushing core inflation higher.

- In mid-September the Federal Reserve cut the federal funds rate by 25 basis points (0.25%).

- Ongoing conflicts in the Middle East and Ukraine continued, contributing to volatility in energy prices and adding to global uncertainty

Economic and Market Review and Update

It has been remarkable how resilient the US economy has been over the past 5 to 10 years. The COVID pandemic shut the economy down to be met by aggressive monetary and fiscal stimulus with only a brief recession ensuing in 2020. The rate cycle turned quickly in 2022 as inflation surged, and the Fed aggressively raised interest rates. Through it all, the economy continued to grow (except briefly in 2020).2025 has been a year of heightened global uncertainty due to shifting U.S. policies, intensifying trade disputes, and ongoing geopolitical tensions. And yet, financial markets are regularly reaching new highs. Is this a “new secular paradigm”?

Recession calls have fallen on deaf ears as this prediction has yet to come true. Have markets become complacent, thinking the economy will continue to avoid any negative impact from higher tariffs as the Fed is cutting interest rates and the AI investment spending boom continues?

The average effective tariff rate is now higher than anytime since the 1930’s. Financial markets have taken “tariff talk” in stride since “Liberation Day” in April. The market has accepted that higher tariffs are a part of US trade policy and, so far, do not seem to be having a significant negative impact on the economy.

But tariff rates are higher, adding to business costs that are either passed through to the consumer as inflation or reduce profit margins impacting investment in capital and labor. Higher tariffs weigh on economic activity. There is a lag as tariffs are announced and implemented.

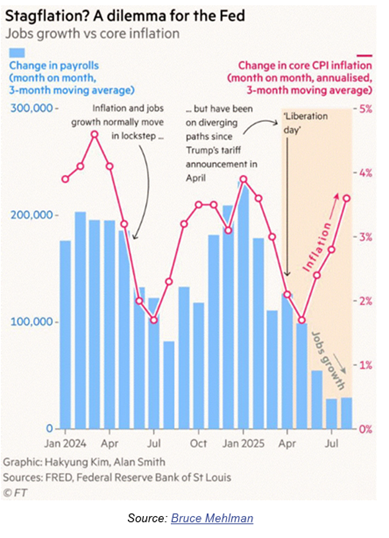

The Federal Reserve has a dilemma. Their “dual mandate” to promote maximum employment and stable prices is at odds. An environment of slowing employment and rising inflation (“stagflation”) is much harder to control.

This chart shows the problem. The blue bars are monthly jobs growth (left scale) and the red line is annualized core CPI inflation (right scale). These normally move together and did so in 2024 and Q1 of 2025. Now they are diverging.

The Fed has been slow to reduce short-term interest rates as they considered that inflation was a greater concern than weaker employment. The unemployment rate remains low, and unemployment claims have yet to move higher.

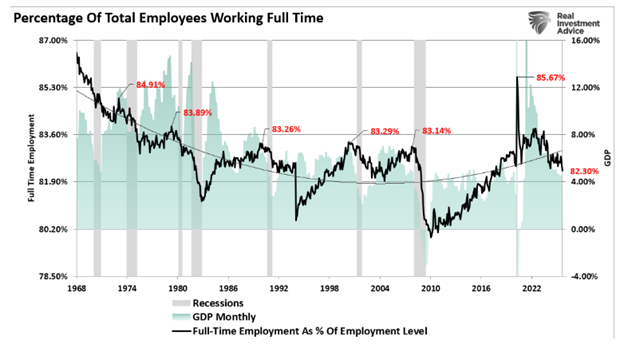

But late this summer, those sentiments changed as weak employment became the greater concern. Data revisions sharply reduced the growth in jobs reflected in the above chart. Another concerning statistic is the percent of full-time workers has slowed. As seen in the chart below, there is a close correlation between full-time employment and economic growth (GDP).

Stance of Policy

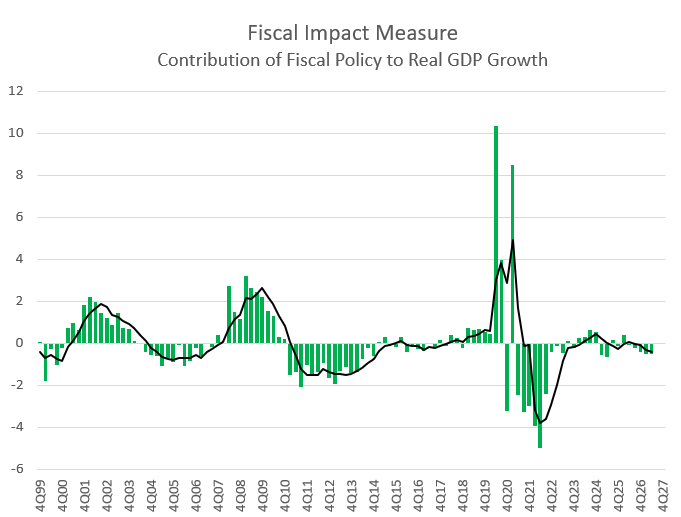

In hindsight, much of the resilience to the economy over the past decade has come from massive monetary and fiscal stimulus. However, this stimulus has waned. The excess savings from Covid stimulus has been depleted, real interest rates (nominal rates less inflation) are positive, and fiscal policy is expected to be roughly neutral for the remainder of 2025.The Hutchins Center calculates a measure of fiscal policy on economic growth called the Fiscal Impact Measure (FIM) (see chart below). The FIM translates changes in taxes and spending at federal, state, and local levels into changes in aggregate demand, illustrating the effect of fiscal policy on real GDP growth.

“The negative 0.6 percentage point second quarter reading reflects a decline in real federal purchases—partially offset by a rise in real state purchases—and the effects of tariff uncertainty on output, which we assume lowered GDP growth by 0.3 percentage point. Transfers net of taxes increased the FIM by less than 0.1 percentage point.

Looking forward, we expect the FIM to be roughly neutral over the second half of 2025, and to average negative 0.1 percentage point in 2026, reflecting a combination of the effects of tariffs and the uncertainty surrounding them, the One Big Beautiful Bill Act (which boosts GDP by about 0.4 percentage point over the remainder of this year and 0.3 percentage point in 2026), and generally weak federal and state and local purchases.” Hutchins Center

Source: RubinBrown Advisors, Hutchins Center as of 2Q25, estimated to 2Q27

Lance Roberts, of Real Investment Advice, wrote on September 26, “The fiscal and monetary buffers that helped cushion previous slowdowns may not be available now. The federal government is already running massive deficits, and interest payments on the debt are now the fastest-growing budget item. On the monetary side, the Fed is caught between two mandates: inflation isn’t fully tamed, but growth is slowing. Cutting rates too soon risks reigniting price pressures; waiting too long deepens a downturn.

So while the S&P may continue to climb for now, and sentiment might stay upbeat, the forward-looking data suggests that caution may be a more prudent approach.”

The S&P 500 hit a series of new highs during the quarter. Is the index at risk?

The bear case for the equity market points to slowing economic growth, high market valuations, extreme investor positioning and inflation that is not fully under control, limiting future Fed interest rate cuts.The bull case focuses on interest rate cuts in a resilient economy, solid corporate earnings particularly in technology and growth industries, and investment in AI and its potential to boost productivity across the economy.

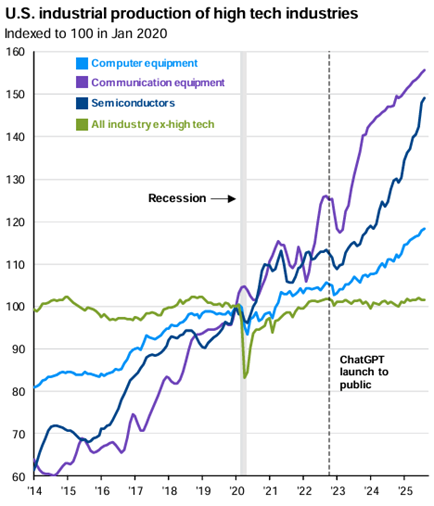

The following chart shows industrial production in high tech industries since 2020. Since ChatGPT was launched in late 2022, production in computer equipment, communication equipment and semiconductors has exploded. All other industries are flat.

AI is a rapidly developing technology with the potential to redefine economic activity – transforming how goods are produced, services are delivered, and value is created across industries. A lot of investment is being made in this technology but the impact on companies and productivity gained from these tools has yet to be seen. Given past technological innovations, significant productivity and growth are possible.

Greg Fleming, the CEO of Rockefeller Capital Management, stated in a recent webcast “When I was at Morgan Stanley, the investment bankers there who did a lot of work in technology had a chart, which I would borrow and give them full credit for, that talked about the number of years for a new technology to be utilized by half of American households. And they started with electricity, and from the time that you could put electricity in a house. and light it, it was 55 years between that and half of American households having electricity in their houses. For the radio, which my father, who's now 92, used to listen to, and everybody did, he was born in 1933, it was 35 years. The TV was 25 years. The iPhone was 4 years. It came out in ‘07, and by 2011, half of the Americans owned an iPhone. When you get to some of the tools of today, ChatGPT, just to pick that. I think it was 18 months to 2 years for 700 million users. And they're starting to use it for all sorts of things now.”

Closing Comments

The world is rapidly changing. Focusing on what you can control can help investing in unpredictable market environments by diversifying your portfolio, managing investment costs and taxes, maintaining a long-term perspective and controlling your savings/spending rate and risk tolerance.Fall and football are here. Soon the leaves will be changing, and cooler temperatures will arrive. Hope you have a wonderful autumn season.

Views expressed are as of the date(s) referenced, based on the information available at that time, and may change based on market and other conditions. These are the views of the authors’ of this piece and may differ from other advisors within RubinBrown Advisors, LLC. RubinBrown Advisors does not assume any duty to update any of the information. Sources referenced are deemed to be reliable, but RubinBrown Advisors has not verified accuracy. Information provided in this piece is for informational and educational purposes only, it should not be construed as a specific recommendation of any security, sector or investment strategy. Please contact your investment advisor to discuss your personal portfolio. Investment decisions should be based on an individual or family’s own goals, time horizon and tolerance for risk.

RubinBrown Advisors, LLC is an SEC-registered investment advisor under the Investment Advisers Act of 1940.

RubinBrown Advisors, LLC is wholly-owned by RubinBrown LLP.