November Market Review: A Pause for Perspective

November Market Review: A Pause for Perspective

Markets navigated a turbulent November as headlines shifted from government shutdown risks to delayed economic releases and renewed debate over AI valuations. While price action captured attention, it tells only part of the story. The market’s recent behavior invites a deeper look at what is driving returns beneath the surface.

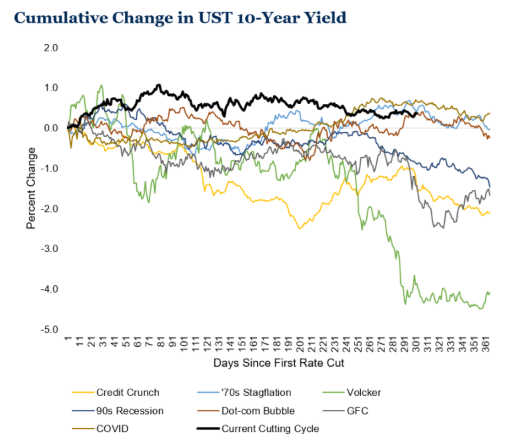

We have now had 175 basis points of rate cuts since the first cut in 2024. The bond market has exhibited a unique response to Fed action, with the long end of the curve persistently rising. In fact, the only significant historical period with similar market action was during 1970’s stagflation. Today, the bond market is seemingly pricing in similar concerns on inflation. This raises the question, what happens when the Fed stops cutting rates? For investors, active management in fixed income may help navigate what could be a non-linear rate environment.

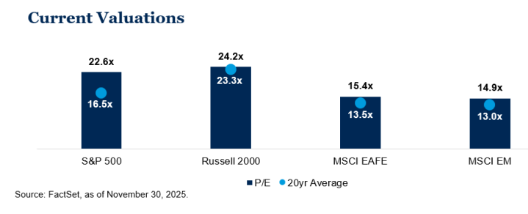

Valuations remain elevated across major indices. The S&P 500’s year-to-date gain of 17.8% (through November 30, 2025) leaves earnings multiples above historical averages. Positive earnings growth provides some justification, but the margin for error narrows. For long-term investors, being mindful of current valuations and thoughtfully allocating portfolios may help attain investment goals.

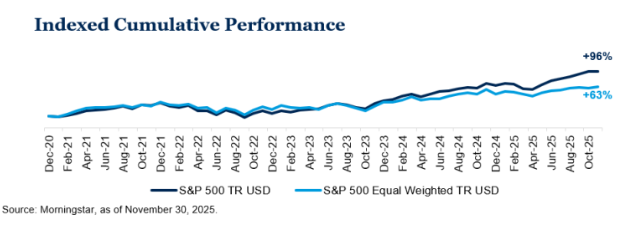

Market concentration remains a defining feature and creates structural risk in portfolios that are not diversified. Today, the top ten stocks in the S&P 500 make up 40% of the total market capitalization, driven predominately by enthusiasm in AI related constituents. Astonishingly, NVIDIA’s market cap has grown to nearly twice the size of the entire Russell 2000. Market leadership has created significant performance dispersion amongst index constituents, which has become more profound since the beginning of 2024. Concentration amplifies both risk and opportunity. Understanding how portfolios are positioned and the underlying exposures will help investors weigh potential market scenarios and the impact they may have on investment outcomes.

Outlook

As the year winds down, markets remain supported by moderating inflation, stable monetary policy and a favorable corporate fundamental backdrop. However, elevated valuations, concentration driven by the strength in AI related securities and persistent macro uncertainty call for thoughtful diversification and disciplined risk management.

Disclosures & Definitions

Views expressed are as of the date(s) referenced, based on the information available at that time, and may change based on market and other conditions. These are the views of the authors’ of this piece and may differ from other advisors within RubinBrown Advisors, LLC. RubinBrown Advisors does not assume any duty to update any of the information. Sources used and referenced in preparing this commentary are deemed to be reliable, but RubinBrown Advisors has not verified their accuracy. Information provided in this email is for informational and educational purposes only, it should not be construed as a specific recommendation of any security, sector or investment strategy. Please contact your investment advisor to discuss your personal portfolio. Investment decisions should be based on an individual or family’s own goals, time horizon and tolerance for risk.

RubinBrown Advisors, LLC is an SEC-registered investment advisor under the Investment Advisers Act of 1940. RubinBrown Advisors, LLC is wholly-owned by RubinBrown LLC.

Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses. Market returns shown in text are as of the publish date and source from Morningstar or FactSet unless otherwise listed.

- The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

- Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

- MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

- MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

- Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

- Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

- FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

- Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

Material Risks

- Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

- Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

- Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

- International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impacted by currency and/or country specific risks which may result in lower liquidity in some markets.

- Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

- Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrower.

All investing involves risk including the potential loss of principal. Market volatility may significantly impact the value of your investments. You should consider these factors when making investment decisions. We recommend consulting with a qualified financial adviser to understand how these risks may affect your portfolio and to develop a strategy that aligns with your financial goals and risk tolerance.