Fourth Quarter Investment Commentary: January 2026

Fourth Quarter Investment Commentary: January 2026

“The year ahead is certain to bring more challenging headlines — whether on known risks like politics, trade, or inflation, or on unforeseen turns of events.

But for investors who can stay disciplined and focused on their financial plan, 2026 could bring opportunities to benefit from a dynamic time in the markets.” - Fidelity

“Far more money has been lost by investors trying to anticipate corrections, or trying to time the market, than has been lost in the corrections themselves.” - Peter Lynch

The Year in Review

- Despite volatility early in the year, equities experienced a notable rally since the April 8 low, particularly led by the technology and artificial intelligence (AI) sectors. Some analysts expressed concern that this performance, combined with ongoing risks, signaled a market bubble.

- Interest rates were volatile in 2025, as the market digested global trade policy shifts, persistent inflation, the government shutdown and a weakening labor market.

- The Federal Reserve resumed cutting interest rates in September after a nine-month hiatus.

- Federal government shutdown in the fall for 43 days, the longest in U.S. history, as Congress failed to pass appropriations legislation for the 2026 fiscal year.

- The One Big, Beautiful Bill Act (OBBBA) was signed into law on July 4, adding stimulus to the economy in early 2026.

- The US Central Bank’s independence was questioned as President Trump pressured Federal Reserve Chairman Powell to reduce interest rates and tried to appoint more Fed Governors who favor rate cuts.

- Conflicts in the Middle East and Ukraine continued, contributing to volatility in energy prices and adding to global uncertainty.

Economic and Market Review and Update

Investors digested a steady stream of headlines this year: tariffs and Liberation Day in the spring, the passing of the “One Big Beautiful Bill,” the Federal Reserve resuming rate cuts after a nine-month pause and an autumn government shutdown that delayed key economic data. Despite the noise and uncertainty, the economy continues to grow, consumers continue to spend and the corporate backdrop remains healthy.

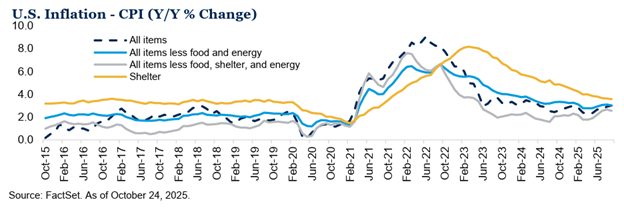

Tariffs dominated the conversation early in the year, starting with threats and uncertainty before settling near an average level of ~17%. While near-term inflation pressure is expected, the longer-term view remains anchored. Inflation has eased from post-pandemic highs but still sits above the Fed’s 2% target. Shelter costs have been moderating, yet many components of CPI remain above 3%. Inflation may ultimately move lower, but the path is likely to be uneven.

The labor market showed cracks as the year progressed, with downward revisions in the summer and shutdown-related disruptions. Job growth remains muted, and unemployment has edged up to 4.6%. This set the stage for the Fed to resume rate cuts in September after a nine-month pause. One cut each in October and December, respectively, left the target rate at 3.50%-3.75%. The government shutdown delayed critical data releases, fueling volatility around the December decision and more uncertainty for 2026 rate expectations, but markets continue to price in additional accommodation next year. Debate over Fed independence and Powell’s successor has added noise and will only increase in the months to come, but market data should remain the key driver of FOMC decisions.

Despite layoff headlines grabbing attention from firms like Meta, the overall employment picture remains stable and the consumer remains resilient. Early data suggest consumers spent nearly $12 billion on Black Friday, a ~9% increase from 2024. Additional stimulus from the “One Big Beautiful Bill” tax cuts, which are estimated to be $150 billion in tax refunds for 2026 and a central bank that is more accommodative lay the groundwork for economic acceleration.

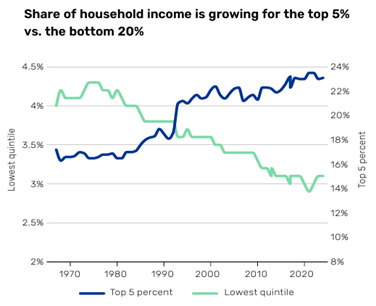

K-shaped economy – bifurcated consumer

The United States is a consumer-driven economy with approximately 70 percent of growth (GDP) attributable to household consumption. Consumer spending has remained resilient heading into 2026 but is being driven by higher income households. Consumer spending has diverged: higher inflation and weaker employment have pressured lower-income households as labor income has slowed. On the other hand, strong financial markets have bolstered wealth and confidence among stockholders. The chart below shows what is referred to as K-shaped – where different earning segments experience diverse outcomes.

Source: University of Michigan Survey of Consumers, 9 November 2025; US Census, 9 September 2025 (data as of 31 December 2024).

Stubborn inflation and a softening job market are expected to weigh on consumers. If there is a stock market downturn in 2026, then consumer spending by high income households could deteriorate.

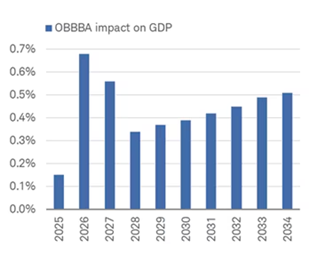

Early in 2026, the One Big Beautiful Bill Act (OBBBA) is estimated to provide positive stimulus to both consumer and business. Analysis from the Joint Committee on Taxation, Congressional Budget Office, and Tax Policy Center show nearly a 0.7-percentage-point boost in 2026 (followed by another considerable lift in 2027), as you can see in the chart below.

Source: Joint Committee on Taxation, Congressional Budget Office, and Tax Policy Center, as of 7/27/2025 (Charles Schwab)

AI Bubble? The Jury is Out

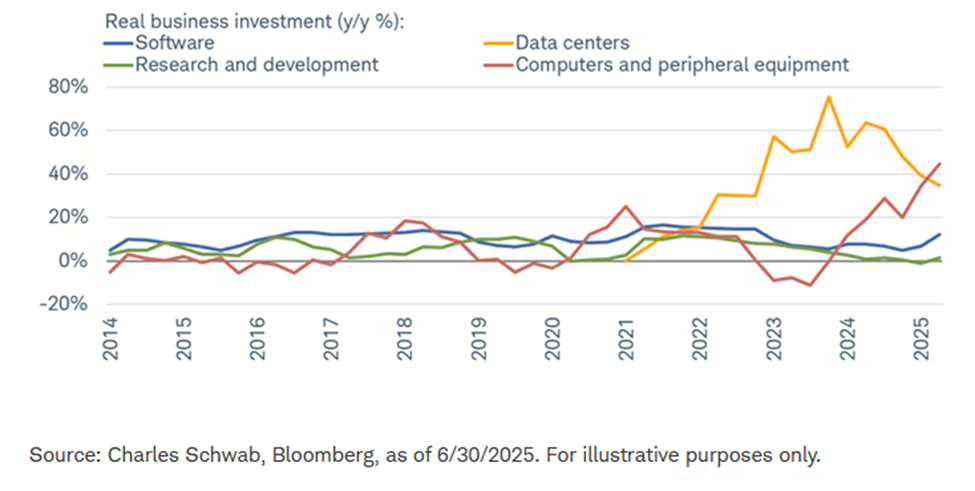

Classic bubbles share a familiar pattern: displacement, boom, euphoria and bust. Displacement often begins with a kernel of truth and a breakthrough that is genuinely transformative. That spark fuels the boom and the exuberance that follows. History offers many examples: the invention of radio, the expansion of U.S. railroads and the fiber-optic buildout that laid the foundation for the internet, just to name a few. Each innovation changed the world, created extraordinary market opportunities and ultimately led to sharp price declines in related stocks and industries after euphoria took it too far.Business investment is an important component of GDP and has been a significant driver of economic growth in recent years. Most recently spending on AI infrastructure including data centers and computers has increased the most (see below chart).

Investment in AI is expected to move from the current dominant infrastructure phase (enablers) to more integration (adopters) to gain efficiencies in business processes.

AI's Investment Grip

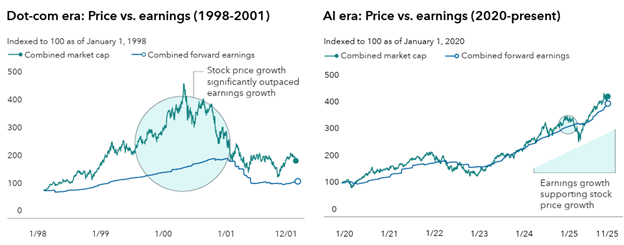

The large increase in the valuations of many of the AI stocks has increased investor concern that we are in an AI bubble. The chart below shows equity prices compared to earnings growth for the Dot-com era and the AI era.

A bubble could be in the making, but unlike the late 1990’s, today’s stock prices for AI leaders are generally supported by solid earnings growth.

Much of the investment has been funded with cash flow rather than with debt. This is beginning to change as debt funding increased late last year.

Eventually, excess enthusiasm, over-investing in AI infrastructure and increased debt-financed investment may lead to excesses and a bubble which bears watching.

Broadening Earnings Growth

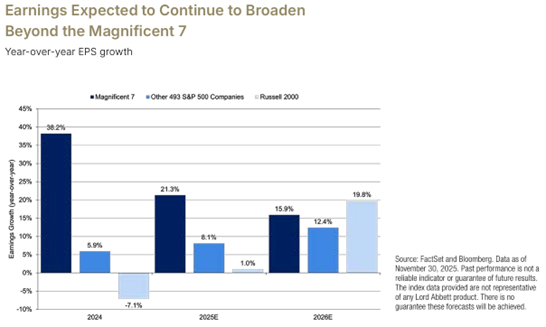

Strong earnings growth supported financial markets in 2025. Analysts expect continued earnings growth in 2026, and there are signs that the earnings picture is becoming healthier.

In the second quarter of 2025, Mag 7 companies generated 27% earnings growth while the other 493 company profits grew by 8.1%. That gap appears to be narrowing. According to Fidelity’s director of quantitative market strategy, median stock earnings finally turned positive in 2025, after a 3-year contraction.

According to Factset Data, earnings are expected to accelerate in both developed and emerging countries’ markets. Year over year earnings per share for the MSCI EAFE are estimated to increase from 8.9% to 10.1% and from 14.6% to 17.0% for the MSCI EM (emerging markets).

Small cap earnings are also improving, marking their best performance in four years and narrowing the gap with large caps. (See chart below)

Market Outlook

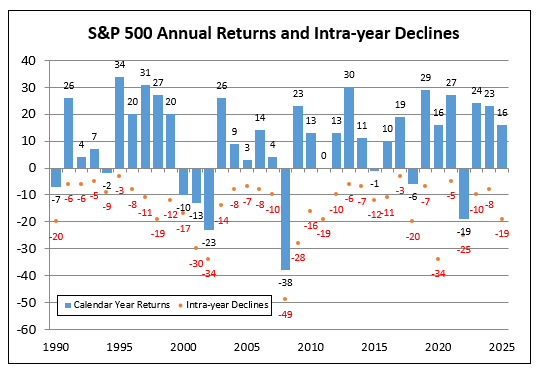

As is possible in any year, a market pullback is possible. Stocks are expensive, optimism is high, and most equity markets have generated strong double-digit annualized returns over the past three years.

“Perhaps that means the better way to think about high valuations is that they make the market more vulnerable to shocks. Higher multiples are generally consistent with optimistic (and at times, euphoric) sentiment, so skittishness tends to kick in at a more aggressive pace when negative news hits the wires. Since we're in an environment of elevated multiples and sentiment—with policy risk not subsiding anytime soon—the bar for a pullback or mini correction in the beginning of 2026 is not terribly high.” –Schwab

The chart below shows the price return and maximum drawdown of the S&P 500 in each year since 1990. Despite significant intra-year declines, the S&P 500 finished most years with positive returns, encouraging investors to stay the course.

Source: RubinBrown Advisors, JP Morgan as of 12/31/2025

“Stock market declines are regular occurrences. The S&P 500 Index has experienced market corrections, or declines of 10 percent or more, about once every 16 months, whereas the index has had bear markets, or declines of 20 percent or more, about once every six years, according to market data from 1954 to 2025.” --Capital group

Watch the Bond Market

“The bond market has stopped responding to the economic data, at least when it comes in weak, nor do Treasuries even respond to the Fed any longer. For the first time ever, we have gone over a year where the Fed cut the funds rate by -175 basis points, and yet the 10-year T-note yield is up over +50 basis points since that first volley in September 2024, and the long bond yield is up by more than +90 basis points. I boil this down to investor nerves and an unwillingness to take on duration risk in this chaotic government policy environment, and no appetite at all to curb the bloated fiscal deficit.” – David Rosenberg

Final Thoughts

We approach 2026 with both optimism and realism. Continued stimulus from a more accommodative Federal Reserve, the “One Big Beautiful Bill” and a resilient economy provide a strong foundation for the transformative changes driven by AI, and, by extension, the markets. That said, we recognize that current valuations and pockets of exuberance around innovation introduce risks.

Disclosures & Definitions

Views expressed are as of the date(s) referenced, based on the information available at that time, and may change based on market and other conditions. These are the views of the authors’ of this piece and may differ from other advisors within RubinBrown Advisors, LLC. RubinBrown Advisors does not assume any duty to update any of the information. Sources used and referenced in preparing this commentary are deemed to be reliable, but RubinBrown Advisors has not verified their accuracy. Information provided in this email is for informational and educational purposes only, it should not be construed as a specific recommendation of any security, sector or investment strategy. Please contact your investment advisor to discuss your personal portfolio. Investment decisions should be based on an individual or family’s own goals, time horizon and tolerance for risk. RubinBrown Advisors, LLC is an SEC-registered investment advisor under the Investment Advisers Act of 1940. RubinBrown Advisors, LLC is wholly-owned by RubinBrown LLC. Comparisons to any indices referenced herein are for illustrative purposes only and are not meant to imply that actual returns or volatility will be similar to the indices. Indices cannot be invested in directly. Unmanaged index returns assume reinvestment of any and all distributions and do not reflect our fees or expenses. Market returns shown in text are as of the publish date and source from Morningstar or FactSet unless otherwise listed.

• The S&P 500 is a capitalization-weighted index designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

• Russell 2000 consists of the 2,000 smallest U.S. companies in the Russell 3000 index.

• MSCI EAFE is an equity index which captures large and mid-cap representation across Developed Markets countries around the world, excluding the U.S. and Canada. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

• MSCI Emerging Markets captures large and mid-cap representation across Emerging Markets countries. The index covers approximately 85% of the free-float adjusted market capitalization in each country.

• Bloomberg U.S. Aggregate Index covers the U.S. investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities, and asset-backed securities.

• Bloomberg U.S. Corporate High Yield Index covers the universe of fixed rate, non-investment grade debt. Eurobonds and debt issues from countries designated as emerging markets (sovereign rating of Baa1/BBB+/BBB+ and below using the middle of Moody’s, S&P, and Fitch) are excluded, but Canadian and global bonds (SEC registered) of issuers in non-EMG countries are included.

• FTSE NAREIT Equity REITs Index contains all Equity REITs not designed as Timber REITs or Infrastructure REITs.

• Bloomberg Commodity Index is calculated on an excess return basis and reflects commodity futures price movements. The index rebalances annually weighted 2/3 by trading volume and 1/3 by world production and weight-caps are applied at the commodity, sector and group level for diversification.

Material Risks

• Fixed Income securities are subject to interest rate risks, the risk of default and liquidity risk. U.S. investors exposed to non-U.S. fixed income may also be subject to currency risk and fluctuations.

• Cash may be subject to the loss of principal and over longer periods of time may lose purchasing power due to inflation.

• Domestic Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry factors, or other macro events. These may happen quickly and unpredictably.

• International Equity can be volatile. The rise or fall in prices take place for a number of reasons including, but not limited to changes to underlying company conditions, sector or industry impacts, or other macro events. These may happen quickly and unpredictably. International equity allocations may also be impacted by currency and/or country specific risks which may result in lower liquidity in some markets.

• Real Assets can be volatile and may include asset segments that may have greater volatility than investment in traditional equity securities. Such volatility could be influenced by a myriad of factors including, but not limited to overall market volatility, changes in interest rates, political and regulatory developments, or other exogenous events like weather or natural disaster.

• Private Real Estate involves higher risk and is suitable only for sophisticated investors. Real estate assets can be volatile and may include unique risks to the asset class like leverage and/or industry, sector or geographical concentration. Declines in real estate value may take place for a number of reasons including, but are not limited to economic conditions, change in condition of the underlying property or defaults by the borrower.

All investing involves risk including the potential loss of principal. Market volatility may significantly impact the value of your investments. Recent tariff announcements may add to this volatility, creating additional economic uncertainty and potentially affecting the value of certain investments. Tariffs can impact various sectors differently, leading to changes in market dynamics and investment performance. You should consider these factors when making investment decisions. We recommend consulting with a qualified financial adviser to understand how these risks may affect your portfolio and to develop a strategy that aligns with your financial goals and risk tolerance